What Are Order Blocks In Forex and How Can You Profit From Them?

Over the last few years, there have been a huge amount of new strategies and developments in the world of retail forex trading. Until more recent years, retail forex traders used to solely rely on technical analysis (E.G support and resistance) to spot trading opportunities. Recently, more trading strategies revolving around institutional trading opportunities have come into the market, with many retail traders hoping to ride the coattails of those moving the markets.

This is how order blocks are formed…

“An order block is an area of price with large volumes of trading positions taken by institutions and banks. This can cause large movements in the prices of currency pairs and also provides potential trading opportunities for retail forex traders.”

In this article, we will take a look at order blocks in the forex market, why they’re useful and how you can profit from them as a trader. Let’s get into it…

What Are Order Blocks In The Forex Market?

Order blocks are a fairly simple concept that is often overcomplicated in the hopes of selling traders a course to explain it.

In simple terms, institutions (such as banks and hedge funds) cannot take all of their positions in one go. Again, in simple terms, the orders they are looking to place are so large that the order itself moves the price of the currency away from that order price, before being able to fill the whole order. Of course, this is massively oversimplified, but the point stands.

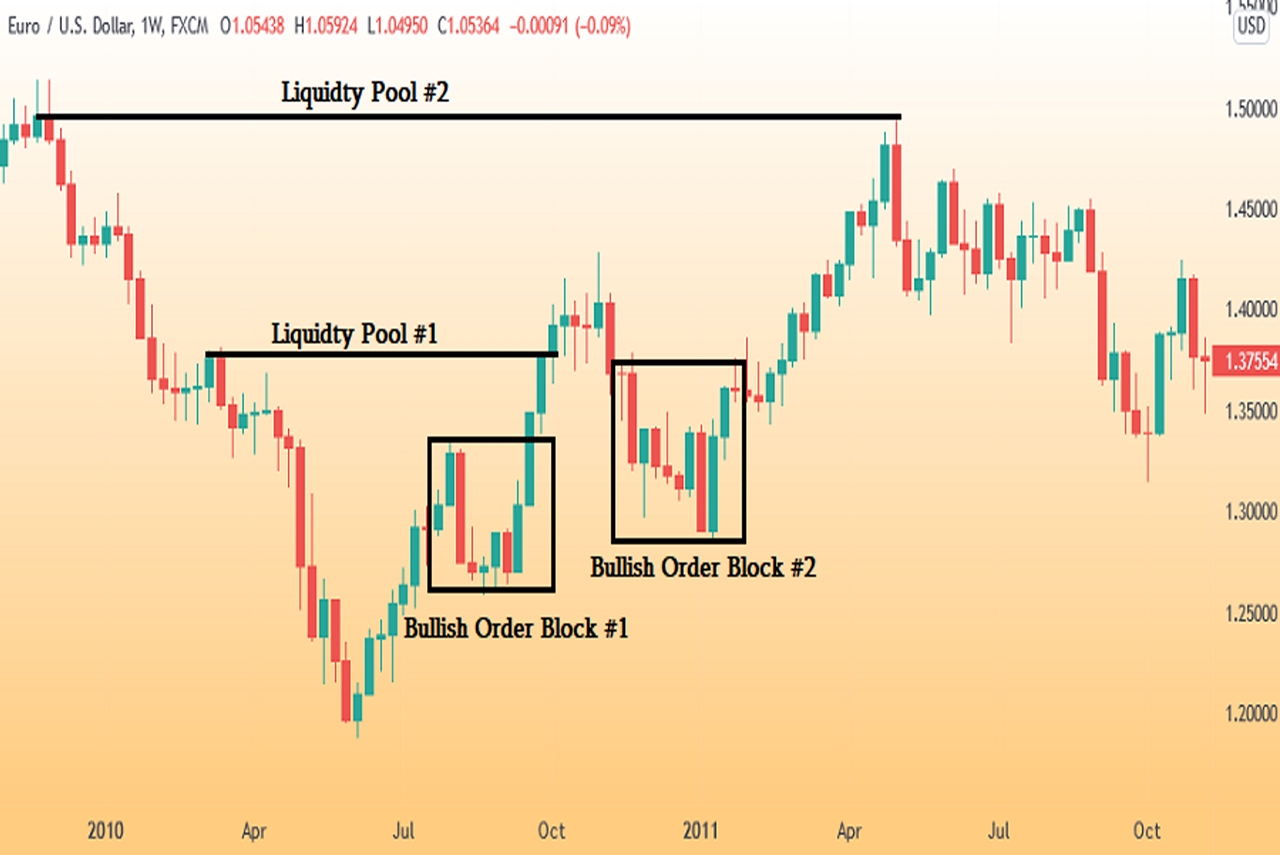

For this reason, the institutions tend to enter a quantity of buy or sell orders in a ‘block’, instead of in one position. These blocks provide an area in which price typically moves away linearly, proving great trading opportunities. In fact, many of our funded traders use order blocks to help create a directional bias on the higher time frame charts, before looking for entry opportunities on the lower time frame charts.

How Do You Find Order Blocks?

Finding an order block isn’t always simple, as the markets do not always give us a clue. In an ideal world, an order block will be an area of consolidation, where positions were building up, followed by a large bullish or bearish run. This chart is showing USDJPY on the daily timeframe. By breaking down the various stages of the market, you can see a clear consolidation (highlighted), where an order block was forming.

Of course, hindsight is a beautiful thing in trading, and this was most likely not going to be obvious at the time of those candlesticks forming.

Price then managed to break rapidly to the upside, emphasizing the fact that large institutions had many positions building up in this area. We know this because without large institutions and sizable positions, we would not have seen a move to the upside in such an aggressive fashion.

This example is showing a bullish order block. Conversely, if price had rapidly moved to the downside after the consolidation range, that would be considered to be a bearish order block. When it comes to drawing the order block, there aren’t any tools or exact science that will be able to help you. In essence, you want to connect the highest point in the consolidation range and the lowest point in the range.

How Can You Trade Forex Order Blocks?

Trading order blocks is a great way to build your trading bias. I’d highly recommend against just setting a pending buy/sell on order blocks, and recommend trying to just using the order blocks to steer your directional bias within the markets.

What does this mean?

Here is a typical order block trade shown on USDJPY. We have an order block, inside an order block, here.

On the 1H chart, there was an obvious/strong bearish order block forming, which contained another 15M order block. The 15M order block gave us a chance to dial into the trade and find a more specific level to be rejected. Of course, we wouldn’t have known that an order block was being created at the time, so there was no real scope for taking a bearish order. However, when price came back to our order block, this is when a bearish opportunity presented itself.

As the order block was being rejected, we would need to start searching for bearish opportunities for entry. Luckily, there was a support level that had been rejected temporarily. This provides an opportunity for us – if USDJPY can break below that level, that provides an opportunity for us to take a short. And this is precisely what happened. With a fairly relaxed stop loss, you would have been walking out of this trade with a 1:2.6 RR. For a trader on a funded trading account, that would be a considerable profit.

Of course, this will not be the only method of entry for these trades. I would highly recommend back testing entry methods in order to build a forex trading plan for you to follow whilst trading.

What Time Frames To Order Blocks Appear On?

In this article, I’ve shown you order blocks created on the daily time frame, the 15-minute and the 1-hour time frame. But order blocks can be created on all time frames, even down to the 1-minute time frame. It’s worth noting that you’re going to see large pip moves from an order block created on a higher time frame. Don’t expect a 1-minute order block to provide a 500 pip win, it’s very unlikely.

In terms of actually trading order blocks profitability, human error and decision-making will play a giant role in your success. If you’re trading the 1-minute time frame, you aren’t allowing yourself much time to make the correct decision and fully analyze the technical and fundamental aspects of your trade. To that end, giving yourself more time to analyze, follow your trading plan and manage your risk appropriately is the best port of call and this will usually lead you to a higher time frame.

In Summary – What Are Order Blocks, And How Can You Trade Them?

In summary, order blocks are areas of high orders being placed by institutions and large trading firms, large enough to move the price of a currency pair. These areas can be exploited by traders using the simple logic that if institutions are buying/selling at that price, you should be riding their coattails and doing the same thing!

This is a popular trading strategy used by some of our funded traders. If you’re looking to obtain a forex prop firm funded account, work with Lux Trading firm now!